Are Adjustable beds and riser recliner chairs eligible for VAT relief?

VAT exemption applies to those registered as disabled or with a recognised long-term illness. While anyone can purchase an adjustable bed or riser recliner chair, non-exempt individuals will incur VAT.

What medical conditions qualify for VAT exemption?

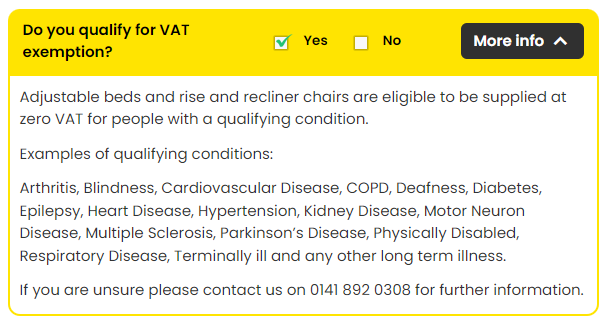

Adjustable beds and rise and recliner chairs are eligible to be supplied at zero VAT for people with a qualifying condition, such as;

Arthritis, Blindness, Cardiovascular Disease, COPD, Deafness, Diabetes, Epilepsy, Heart Disease, Hypertension, Kidney Disease, Motor Neuron Disease, Multiple Sclerosis, Parkinson’s Disease, Physically Disabled, Respiratory Disease, Terminally ill and any other long term illness.

How does it work?

On any product that is VAT exempt you will be asked to tick Yes if you are VAT exempt or No if you are not. The default is set to Yes. See below.

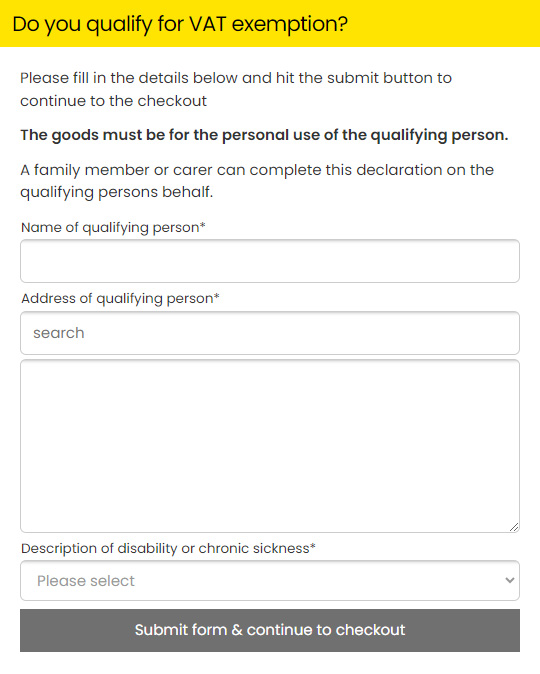

Once you add your product to the basket you will be asked to fill out a self declaration form. See below.

This exemption helps make essential living more affordable for those who need them due to health conditions, allowing for greater independence and quality of life.